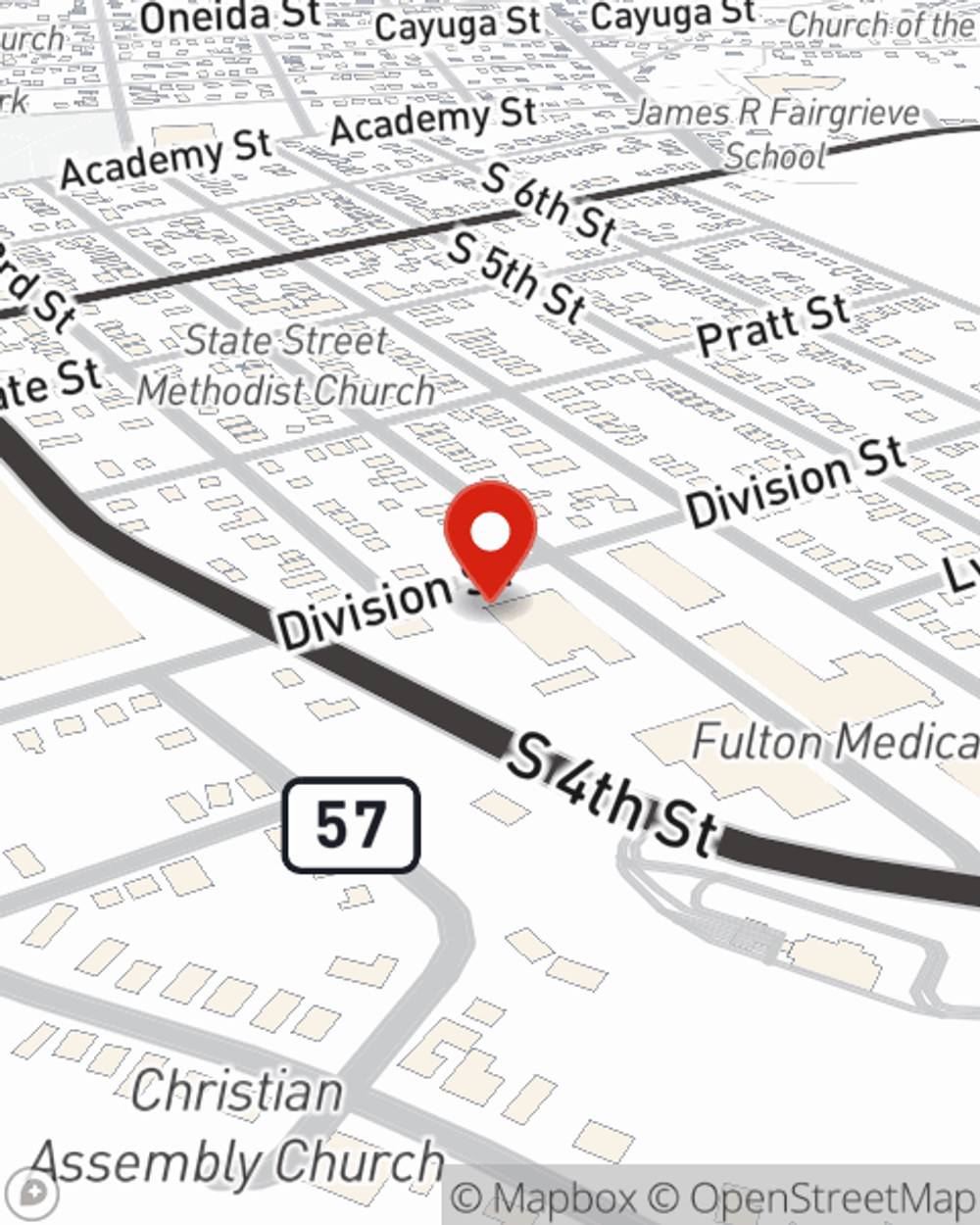

Business Insurance in and around Fulton

Looking for small business insurance coverage?

Insure your business, intentionally

- Oswego County

- Onondaga County

- Jefferson County

- Cayuga County

- Erie County

- Oneida County

- Madison County

- Lewis County

- Wayne County

- Seneca County

- Cortland County

- North Country

- CNY

- Upstate

- Downstate

- ADK

- Western NY

- Westchester County

This Coverage Is Worth It.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all by yourself. As someone who also runs a business, State Farm agent Janet Lake knows what it's like to put in the work that it takes and would love to help lift some of the burden. This is protection you'll definitely want to investigate.

Looking for small business insurance coverage?

Insure your business, intentionally

Get Down To Business With State Farm

Whether you are an acupuncturist a drywall installer, or you own an advertising agency, State Farm may cover you. After all, we've been doing it for almost 100 years! State Farm agent Janet Lake can help you discover coverage that's right for you and your business. Your business policy can cover things such as buildings you own and accounts receivable.

Contact the exceptional team at agent Janet Lake's office to explore the options that may be right for you and your small business.

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Janet Lake

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.